Fundraising is a daunting prospect for any business. Fundraising for EV charging projects in 2025 amidst an AI boom and the current macro sentiment around EVs in America is a different level of daunting.

While investors salivate over AI companies that hit $100m ARR with 10 employees, EV charging is often only appearing in the headlines when something negative happens: Chargers being ripped out at federal properties. NEVI funds redistributed (but also now back from the dead after a wholly unnecessary 6-month delay?). EV demand set to fall off a cliff when tax credits expire at the end of September.

And yet, to people that pay close attention, EV charging companies and sites are starting to finally produce numbers that make them attractive investment targets.

To get ahead of rebuttals, this is not the case in every state in the US. Nor is every DC site humming in terms of utilization in higher-adopting European countries. Site economics will vary widely across a number of variables: state to state, urban vs. rural, small vs. large, slower vs. faster, and required upfront capital.

No one is suggesting putting in eight 300 kW chargers for $1M in Pierre, South Dakota. The payback period on that is going to be LONG. There are, however, companies, operators, and investors that are seeing significant utilization at right-sized sites in the right locations.

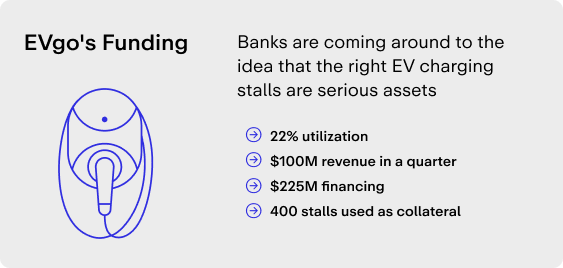

The EVgo example

EVgo is an excellent example (and also one of the easier ones to point to given they are a publicly traded company so they have to publish their numbers). They are now averaging 22% utilization across their network of 4k+ stalls. This led to almost $100m in revenue in a single quarter.

This performance enabled them to close on a financing vehicle of $225m from multiple major banks that is intended to fuel their further expansion in the coming years. There was a unique element of the financing as well: 400 EVgo stalls were put up as collateral for the loan. This shows that banks are coming around to the idea that the right EV charging stalls are serious assets (whether they were able to select which stalls were included as collateral would be interesting to know).

Now, EVgo’s stock price is not some rocket ship. ChargePoint and Blink – other publicly traded charging companies – are similarly struggling stocks. But EVgo’s numbers as a pure play public CPO (their model is a fair bit different from ChargePoint), are one example of a slowly maturing asset class.

There are unfortunately few other pure-play public CPOs in America to compare with EVfo. There are, however, many state-level and regional operators spread throughout the country. These operators are out there actively fundraising, speaking to infrastructure funds and private equity firms. And there is now private money flowing under the radar to CPOs that can put together a compelling portfolio. These investments fly in the face of public perception of a dried up sector.

How do you de-risk this sort of investment, especially in the USA under the current administration?

People – investors – can read headlines in the Wall Street Journal or Bloomberg. They can look at recent quarterly reports from Ford and GM and see how many EVs they sold. They can parse comments from Mary Barra or Jim Farley to see the direction of travel for EV investments in coming years. The picture they might be left with is not overwhelmingly positive.

So why might investors be warming up to EV charging investments? It is fairly straightforward: these are becoming less risky investments. Why? More EVs are steadily entering the stock of American vehicles every month and these vehicles need to charge.

A DC charging site is really only trading in one thing: kWh. There are not multiple products on site. Sure, a coffee shop can be a revenue stream. But a site’s success boils down to one thing: how many vehicles are going to show up and charge?

DC charging sites are not cheap to build. There is a major upfront cost to install the chargers. This includes site design, analysis, permitting, hardware procurement, and labor. Once the chargers are in the ground, it becomes a question of utilization. Put simply, how many kWh can your chargers pump into vehicles on a daily/weekly/monthly basis? And can you keep your costs to a minimum while delivering those kWh?

An investor is looking at the cost to install the chargers and calculating how long it will take to recoup initial investment costs and expected profit beyond that breakeven point.

The math on these investments is going to be very much site-dependent.

So, what are the key metrics that an investor should consider?

- Upfront costs

- How many chargers are being installed?

- How much do those chargers cost?

- What are site analysis, permitting, design, and installation costs?

- Utilization

- How many kWh / stall / day can be expected?

- How quickly does utilization ramp up to expected peak?

- What type of utilization per day/week/month is needed to pay back initial investment?

- You can arrive at some reasonable estimates based on metrics like:

- Surrounding area EV adoption

- Average income

- Average miles traveled to site

- Multi-family vs. single home (companies like Stable Auto have built this data aggregation and modeling into a product)

- Other elements can move the utilization dial like local fleet agreements, discoverability, and marketing

- How many kWh / stall / day can be expected?

- Margins

- What can be reasonably charged / kWh?

- What are blended costs /kWh? (taking demand charges into account?)

- What is the right pricing strategy to attract drivers but maintain a healthy margin?

- What are per stall costs with the landlord? ($$ / stall / month or revenue share are most common models)

- Cost of capital

- What is it costing you as an investor to provide the capital

Answering the above questions will get an investor pretty far into understanding the economics and potential returns of a charging investment.

Potential Risks

DC charging is not a risk free investment. Those metrics can be slightly tweaked to represent the risks to take into account:

Low utilization

- Poor site selection

- EV adoption in surrounding area very low

- Low visibility / awareness of site

Higher-than-expected costs

- Unexpected maintenance costs (faulty HW or SW)

- Spiking electricity costs

- Charger vandalism

Reputational Risks

- Bad hardware/software leading to:

- Failed charges

- Lost revenue

- Drivers not returning due to reduced trust in charging site

- Downtime = chargers not earning

- Costly replacement of faulty chargers

These risks are enough to drive away investors. The numbers just don’t quite add up. The payback period is going to take forever. How can those utilization projections be believed?

How to De-Risk Charging Investments

There are ways to offset your risk and put a floor on your utilization.

- First and foremost, be very thoughtful around site selection. There are a number of software tools like Stable Auto and EVPin that have advanced models that can contribute to smarter site selection.

- Next, pick quality hardware that fits well to the site’s needs. Not every site needs a 400 kW charger. Some sites have longer dwell time and an ultra-fast charge is frankly too fast for a trip into the grocery store. In terms of quality, the surest way to keep maintenance costs low is if your HW is so reliable, you are rarely having to call a tech on site. The units stay online and deliver successful chargers >90% of the time. Monta also has great third-party data on HW quality.

- Pick high-quality software that delivers market-leading uptime, data, and insights into your charging network. There is really only one CPMS when those are your criteria.

- Finally – and this is related to software – you need to maximize discoverability and put in place local fleet agreements. Discoverability means every map and charging app displays your charger. So when a new – or prospective – EV driver enters in “ev charger” in Google Maps, there is your site front and center. Local fleets are captive audiences. This could be taxi companies, ride-sharing cos., and increasingly, autonomous vehicle fleets. These are vehicles that will be on the road all day long, needing to repeatedly charge. These fleets can ensure a high floor of utilization, especially in urban centers where they are operating.

When you get these critical elements in place, you give your site every chance to succeed.

The Simple Truth

I always come back to a simple, unavoidable point: there will be more EVs on the road in 2035 vs. 2025. America’s EV trajectory might not be as steep as those of us in the industry might hope, but the direction of travel is only headed one way.

The EVs that will enter the nation’s fleet in coming years will need to charge. Yes, home charging will always make up the bulk of charging. But the demand for fast charging sites and public kWh will only increase. There is still a paucity of public charging sites in so many areas around the country. The best sites have not all been snapped up. Far from it.

However, at some point the quality of sites will deteriorate. That prime shopping center in a high-earning, high-adopting suburb will have chargers. Same goes for gas stations, Starbucks, and top retailers. Operators and investors that act now are snapping up those sites. They can sign lengthy leases and watch utilization steadily creep up over the months and years. They are learning every day how to run a high-quality charging site while keeping costs to a minimum.

Will the site pay itself back in three years? Five years? Seven? It is very difficult to predict. But upfront costs will eventually be recouped. From that point on, profits will be made. It may not generate AI startup-like returns, but high-earning sites can be a steady source of profits for many years to come.

This is why, despite a slight slump in EV adoption in 2025, America has seen record charger infrastructure buildout. Q2 2025 recorded record charger installations in America and the country is on track to add more than 16,000 fast chargers in 2025. The pace of installation continues to pick up as operators realize now is the time to put chargers in the ground.

These projects also simply require a lot of time. A DC fast charger that goes in the ground in September 2025 likely started its permitting journey back when Joe Biden was still president. If an operator has secured permitting for a promising site, it would not be wise to just slam the brakes on it due to recent legislation being passed. More EVs will be on the road in coming years and the buildout is happening now.

Conclusion

EV charging infrastructure investments will rarely make splashy headlines. The headlines won’t tell you when a site hits breakeven. But funding rounds will keep coming as investors realize the gold isn’t in the hype cycles. It’s in the kWh quietly flowing through stations they financed five years ago.