In Europe, utilities are playing a very different game when it comes to EV charging. And it’s not just about supplying electricity. Many utilities (or their subsidiaries) actually operate the charging networks. Norlys in Denmark, one of Monta’s largest partners, runs a broad operation spanning DC fast charging, workplace setups, on-street chargers, and in-home solutions.

This trend is consistent across Europe. EDF in France, Iberdrola in Spain, Enel X in Italy. All major energy players also act as charging network operators. For providers of EV charging software, these utilities are prime targets.

But cross the Atlantic, and you’ll find a stark contrast.

What Is a Utility Rebate?

Utility rebates act as a financial nudge. Instead of building public EV charging infrastructure themselves, many U.S. utilities offer cash incentives to those who will. These rebates help cover installation and hardware costs. Sometimes it can be just a few thousand dollars per EV charger, sometimes significantly more for fast-charging projects.

But it’s not a free lunch. In return, utilities want something back: data. Operators must use pre-approved hardware, share charging session information, and often meet specific formatting and reporting requirements. The end goal? Better visibility into grid impact, smoother energy planning, and a faster rollout of EV charging equipment without the utility needing to become a network operator.

Role of Utilities in EV Charging in the USA

In the US, utilities are rarely the ones building or operating public charging networks. There are some exceptions, like FPL Evolution, but they’re few and far between. Why? A mix of low electric vehicle adoption in some regions, a lack of clear revenue incentive, and heavy lobbying from companies like ChargePoint, which have pushed regulators to keep utilities out of the network business.

So while utilities benefit from the increased power usage that electric vehicles bring, they tend to leave the infrastructure build-out to private actors. Their role? Supporting from the sidelines, often through generous funding mechanisms.

Utility Rebate Programs Are Shaping the EV Charging Infrastructure Landscape

Instead of building networks, utilities offer a range of rebate programs to encourage others to do it. These programs help offset the high upfront costs of charging infrastructure, which can otherwise be a serious barrier to entry.

Depending on the utility and location, available incentives range from $1,000 to $5,000 for a Level 2 charger to upwards of $40,000 or more for a DC fast charger. Here are some key examples:

- SCE Charge Ready Transport: Helps businesses install charging for electric fleets at little to no cost.

- National Grid’s Public/Workplace Program: Covers up to 100% of electrical infrastructure costs and offers charging equipment rebates.

- FirstEnergy NJ EV Program: Up to $50,500 per DCFC port and $11,100 for Level 2 installations.

- NYSERDA Charge Ready NY 2.0: Offers $2,000 to $4,000 per port for Level 2 EV chargers.

- Avista’s Business Charging: Covers up to $5,000 per port for Level 2 EV charging stations.

These incentive amounts make projects more financially feasible, especially for businesses or municipalities. But they come with strings attached.

The Hidden Complexity: Data Sharing and Compliance

To benefit from a utility rebate program, operators must adhere to strict technical and administrative requirements. Chief among them? Data sharing.

Rebates are typically tied to EV charging equipment on an Approved Provider List (APL) or Qualified Product List (QPL). To stay compliant, operators must use approved EVSE and submit detailed usage data to the utility. This often includes:

- Session start and stop times

- Serial numbers of chargers

- Peak power levels

- Total energy dispensed

Why so much data? Utilities need to plan and monitor grid impact. But compliance is no small feat. There’s almost no standardization across utilities. Some require monthly reports, others quarterly. In Colorado, you might submit Session Time in column D. In Washington State, it’s column F. Some want annual summaries. Others request 15-minute interval data, which generates massive files.

For Monta, this means understanding and adapting to each program’s unique demands. While Monta doesn’t operate networks directly, our software supports partners who must report this data. That makes us part of the compliance equation.

And we’ve gone all-in. We’re now approved for over 15 major programs in the US. But it hasn’t been easy. Some utilities (notably Eversource and National Grid in the Northeast) remain reluctant to expand their APLs. That’s a bottleneck. We’ve had deals stall because Monta isn’t listed on an obscure PDF buried on a utility website.

Even more frustrating? Often, the data collected isn’t even reviewed by the utilities. It’s handled by third-party aggregators. And those aggregators can’t always explain how, or if, the data is used meaningfully.

Carbon Credits and the Fine Print

Here’s where things get even more interesting. California (and increasingly, Oregon and Washington) operates under the Low Carbon Fuel Standard (LCFS), a system that assigns tradable credits to low-carbon fuel producers.

EV charging operators can earn LCFS credits based on electricity dispensed. These credits have real monetary value and can be sold to companies that produce more carbon-intensive fuels.

But there’s a catch. Many utility incentive agreements include clauses that transfer the rights to these credits to the utility itself. It’s buried in the data sharing agreement. So while you might save $10K on your install, you could be forfeiting tens of thousands in long-term credit revenue.

This isn’t always disclosed clearly. Some operators only realize they’ve signed away credit rights after the fact.

The Monta Approach: Compliance as a Service

At Monta, our core philosophy is to empower operators. More control, more transparency, better tools.

But rebate compliance is the one area where we take a different approach. Our partners don’t want to deal with complicated CSV formats or monthly submissions to four different utilities. They want hands-off compliance.

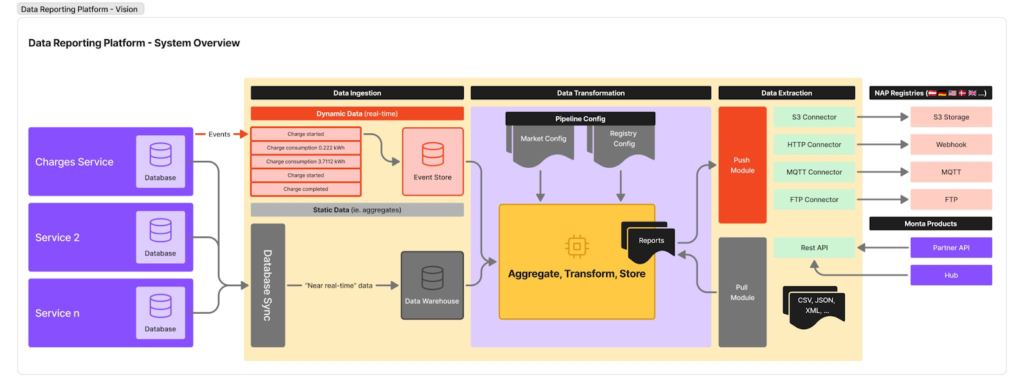

That’s why we’re building a comprehensive data sharing architecture that automates the entire flow:

- Data ingestion: Collecting raw charger session data

- Data transformation: Formatting per utility-specific schema

- Data extraction: Automated report generation and delivery

We know how fragmented the landscape is, and we’re building for scale across the US and Europe. Our platform is already integrated with multiple country-level registries in Europe and many utility portals in the US.

Operators using Monta don’t need to worry about whether “Port ID” goes in Column G or if the serial number requires a 10-digit format. We handle it.

There’s more on this in our article: The rise of data sharing in the EV charging ecosystem.

Bottom Line

Utilities in the US aren’t competing with network operators. They’re funding them. Through the rebate program ecosystem, they’re catalyzing infrastructure growth without taking on the operational burden.

But with every dollar of funding comes a data requirement. For operators, the real challenge isn’t just installing hardware. It’s staying compliant with evolving, inconsistent rules.

That’s why Monta is going beyond traditional CPMS. We’re not just a tool to manage EV chargers. We’re a platform for rebate-ready, regulation-compliant, operator-friendly EV charging networks. One that understands how the system works and where the pitfalls lie.

Let the utilities fund the buildout. We’ll handle the fine print.