What’s in scope?

The e-invoicing mandate applies to domestic transactions where both supplier and buyer are registered for VAT in Belgium and that have a fixed establishment in Belgium.

In scope

Both the supplier and buyer are Belgian-established businesses, and the transaction involves the supply of goods or services subject to VAT in Belgium.

Out of scope

The following transactions are not subject to e-invoicing requirements:

- Transactions with Monta, since Monta does not have a fixed establishment in Belgium

- Transactions with consumers (B2C)

- Transactions with non-established or foreign businesses

- Non-sale transactions, such as home reimbursements or internal transfers

What This Means for You

Monta as Marketplace

On the Monta platform, you can buy and sell from other actors (operators, teams, partners, etc.).

This means that some of your transactions may be in scope for e-invoicing, and if that is the case these need to be sent as structured e-invoices through Peppol.

Note: Depending on your setup with Monta, you may only transact with Monta ApS and not any other parties on the platform. For some of our customers, Monta steps in as the reseller of all electricity sales and purchases. This effectively means no B2B transactions between Belgian businesses on the platform, eliminating the e-invoicing obligation for those activities.

If You’re a Seller

- Monta automatically sends e-invoices on your behalf when required by Belgian law.

- This ensures that your buyers always receive VAT-compliant documentation.

- You don’t need to take action or manually issue invoices – Monta handles this automatically.

- Payment: You’ve already received payment via your Monta Wallet in real time when the transaction occurred, so the e-invoice is purely documentary.

If You’re a Buyer

- Monta automatically sends e-invoices to you on behalf of the Seller.

- These invoices are already settled through your Monta Wallet – no separate payment is required.

How Monta Handles E-Invoicing

To simplify the process and avoid sending an invoice per transaction:

- Monta will consolidate all transactions per seller–buyer pair each month and issue one e-invoice via Peppol.

- Individual receipts will continue to be generated in real time for transparency and reconciliation but can no longer be used as a valid VAT documentation.

- The VAT-valid document for Belgian compliance is the structured e-invoice transmitted through Peppol for the transactions in scope.

Our E-Invoicing Solution

To deliver and receive e-invoices through the Peppol network, Monta partners with a certified Peppol Access Point provider.

Account Setup Requirements

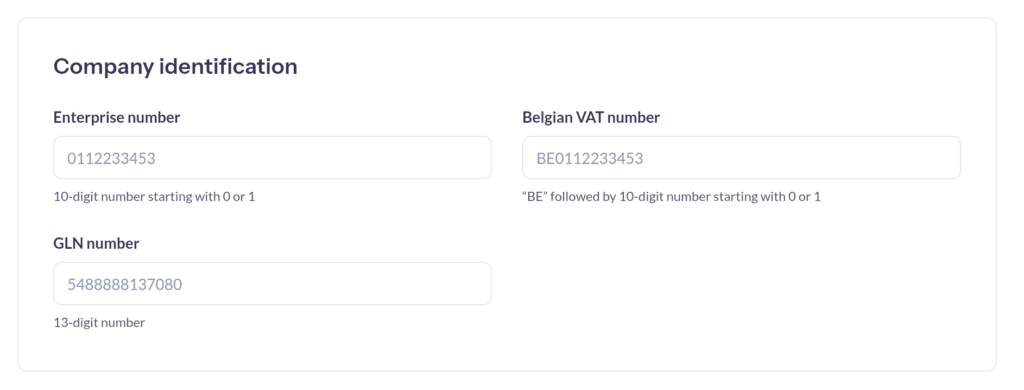

To be able to send and receive e-invoices, make sure all your identifiers are up to date in the Monta Hub. Add any identifier that applies to your business – such as your Belgian VAT ID, Enterprise number, or GLN number – under Account Settings. Monta uses these identifiers for e-invoices sent both on your behalf and to you.

By providing all relevant identifiers, the system will automatically use the applicable one to ensure your invoices are routed correctly. This ensures a seamless process for e-invoices related to purchases made on the Monta platform between you and other Belgian businesses.

Not having a valid ID may cause invoice transmission failures.

How does this affect your Monta invoice?

Your Monta invoice – which includes a Wallet activity statement – will remain unchanged.

A subset of the transactions listed under the Marketplace activity section (i.e., transactions between you and other parties on the Monta platform that do not involve Monta) in the Wallet activity statement are in scope for e-invoicing. These transactions continue to be added to your wallet and still impact your monthly Final Amount Due.

What changes is the type of VAT documentation that is considered valid for these transactions:

VAT documentation

- Before 1 January 2026: Receipts serve as the valid VAT documentation.

- From 1 January 2026 onward: E-invoices become the valid VAT documentation.

Note: The Wallet activity statement attached to your Monta invoice has never served as valid VAT documentation for these marketplace transactions.